You and your honey have been seeing each other for a while now. Perhaps you’re already living together (in sin, high five!) Things are going great and you have every reason to expect that they will continue to do so for as long as you care to imagine. So let’s talk a little business. To what extent should you two lovebirds combine your finances?

Will Combining Finances Destroy Your Relationship?

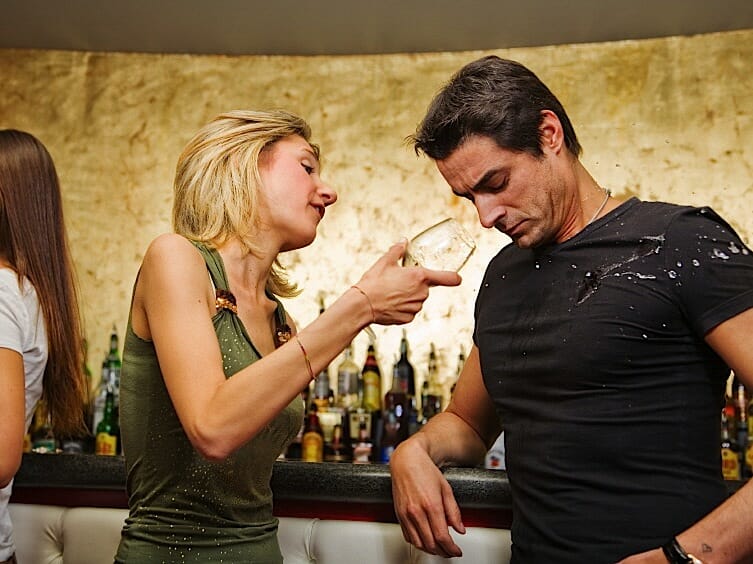

If you haven’t thought about it before, maybe it’s time. Sharing expenses can save you some good money. Rent on one pad is cheaper than two. Family cell phone plans save money. Why keep two Netflix accounts? What could possibly go wrong? The view through your fancy, Elton John-style, rose colored glasses might make it seem like the only things you’ll need to make your relationship work are love and lots of vigorous sex. In the real world, however, not many things can match money trouble for sheer, teeth-gnashing, relationship-destroying power.

Some couples will prefer to keep things separate: half-and-half on the rent and utilities; separate groceries and phones; and Dutch on every bar tab. Other couples will be perfectly comfortable pouring all of their bread into a joint checking account and letting fate sort it out. No one way will be right for everyone. Here are several things to consider.

If yours and your honey’s paycheck match dollar-for-dollar, you may expect that each of you will pitch in an equal amount of dough to keep to homestead running. However, if you’re a musician or a public school teacher and your significant other is a biochemist or a crooked lobbyist, it’s likely that one of you is supporting the other in ways that don’t involve money. In that case, it might not make sense to split expenses down the middle. Think about the different ways that you contribute when you’re deciding how to figure this all out.

Who Will Manage The Finances?

Another difference between partners might be their level of financial prowess. If you have a credit score lower than the monthly payment on your 1993 Ford Escort, and your partner’s score is best expressed in scientific notation, proceed with caution. That stellar credit score came from years of diligent responsibility and you don’t want to screw it up. On the other hand, one of you is clearly better at the whole money and bills business. Maybe you should let Mr. or Ms. Responsible handle all of the money stuff.

Two more important things to consider are trust and privacy. If you’re a shopaholic with poor financial self-control, that doesn’t necessarily mean that you’re not relationship material; we all have our little flaws. You just might want to make sure you’re playing Supermarket Sweep with your own money. Also, if you value your privacy when it comes to the purchases you make, you may want to make sure that you have at least a portion of the money you make kept separate from the joint account. After all, if you’re considering marrying your finances, marrying your selves might not be too far behind, and not many things can spoil a three-carat surprise like a joint checking account!